Registering Foreign Companies in the UK: Simple Steps

The UK is one of the most popular jurisdictions for establishing a foreign company. It offers the opportunity to expand the audience, attract new partners, and reduce the tax burden.

Many business owners specifically choose the capital for this purpose.

Let's explore how to register a company in London, what to consider regarding reporting and the tax system, which documents are required for registration, and how to simplify this process.

Registering a Legal Entity in London

To start a business in the UK, you will need to:

- Choose a Name. There are several rules to follow. The name must not be offensive or too similar to an existing business. Additionally, there is a list of prohibited words (e.g., Imperial, Empire) that cannot be used in the company name.

- Choose a Business Structure. The most popular business forms in the UK are LLP (Limited Liability Partnership). This structure allows for tax reduction using a pass-through taxation system. LTD (Limited Company). This structure provides more opportunities for running a business and offers tax advantages and exemptions.

- Prepare Documents. All provided information must be accurate and up-to-date, and if submitting electronically, it must meet the registration body's requirements.

- Create a Website. The company's official website should provide clients and partners with current business information, collaboration terms, and privacy policy. This is necessary for connecting payment systems.

- Determine Founders. For an LLP, a minimum of two founders (partners) is required. An LTD company can be established by one founder, who can be either an individual or a legal entity.

- Submit an Application. Submit the application to the registration body along with the necessary documents.

- Rent a Legal Address in London. Even if business activities are carried out remotely, a physical address is required for receiving correspondence. Additional documents, such as a lease agreement, might also be necessary.

The final step in the registration process is to open a bank account. This account can be set up once the registration body approves the application for the legal entity. The account is needed for transactions with clients and contractors, salary payments, and using payment systems.

Required Documents

To register a company in the UK, you will need the following documents:

- Identity Proof. National passport or, if applicable, an international passport.

- Two Proofs of Address. Typically, utility bills are used to confirm the address. Other options include bank statements and government letters. The address and personal details on both documents should match.

Tax System

Taxes in the UK depend on the company structure chosen during registration:

- LTD: This company pays corporate tax at a basic rate of 19%. If the company's income exceeds £1.5 million, the rate increases to 30%. Additionally, businesses engaged in oil extraction pay a 20% extra levy.

- LLP: This operates under a pass-through taxation system. The company itself does not pay taxes on income. Instead, the partners (beneficiaries) pay taxes as individuals at the rate of their home country.

Besides income tax, the UK tax system includes the following fees applicable to businesses:

Besides income tax, the UK tax system includes the following fees applicable to businesses:

- Stamp Duty on real estate transactions.

- Excise Duties for fuel, tobacco, alcohol, and gambling.

- Municipal Taxes.

- VAT at the basic rate of 20%.

The UK is one of the most popular jurisdictions for establishing a foreign company. It offers the opportunity to expand the audience, attract new partners, and reduce the tax burden. Many business owners specifically choose the capital for this purpose.

Let's explore how to register a company in London, what to consider regarding reporting and the tax system, which documents are required for registration, and how to simplify this process.

Registering a Legal Entity in London

To start a business in the UK, you will need to:

- Choose a Name. There are several rules to follow. The name must not be offensive or too similar to an existing business. Additionally, there is a list of prohibited words (e.g., Imperial, Empire) that cannot be used in the company name.

- Choose a Business Structure. The most popular business forms in the UK are LLP (Limited Liability Partnership). This structure allows for tax reduction using a pass-through taxation system. LTD (Limited Company). This structure provides more opportunities for running a business and offers tax advantages and exemptions.

- Prepare Documents. All provided information must be accurate and up-to-date, and if submitting electronically, it must meet the registration body's requirements.

- Create a Website. The company's official website should provide clients and partners with current business information, collaboration terms, and privacy policy. This is necessary for connecting payment systems.

- Determine Founders. For an LLP, a minimum of two founders (partners) is required. An LTD company can be established by one founder, who can be either an individual or a legal entity.

- Submit an Application. Submit the application to the registration body along with the necessary documents.

- Rent a Legal Address in London. Even if business activities are carried out remotely, a physical address is required for receiving correspondence. Additional documents, such as a lease agreement, might also be necessary.

The final step in the registration process is to open a bank account. This account can be set up once the registration body approves the application for the legal entity. The account is needed for transactions with clients and contractors, salary payments, and using payment systems.

Required Documents

To register a company in the UK, you will need the following documents:

- Identity Proof. National passport or, if applicable, an international passport.

- Two Proofs of Address. Typically, utility bills are used to confirm the address. Other options include bank statements and government letters. The address and personal details on both documents should match.

Tax System

Taxes in the UK depend on the company structure chosen during registration:

- LTD: This company pays corporate tax at a basic rate of 19%. If the company's income exceeds £1.5 million, the rate increases to 30%. Additionally, businesses engaged in oil extraction pay a 20% extra levy.

- LLP: This operates under a pass-through taxation system. The company itself does not pay taxes on income. Instead, the partners (beneficiaries) pay taxes as individuals at the rate of their home country.

Besides income tax, the UK tax system includes the following fees applicable to businesses:

- Stamp Duty on real estate transactions.

- Excise Duties for fuel, tobacco, alcohol, and gambling.

- Municipal Taxes.

- VAT at the basic rate of 20%.

Opening a Business Account

Having a business account in the company's name is essential for conducting financial operations, from transactions with clients to paying salaries. However, opening a business account in a UK bank can be inconvenient due to security requirements, such as the necessity for in-person presence to open an account. This can be an issue for entrepreneurs planning to operate entirely remotely.

A more convenient solution is using services like Neobanks. These online organizations offer all the services of a traditional bank, allowing you to open an account remotely in a minimal amount of time. Moreover, many neobanks offer more favorable rates due to their online format and lack of physical branches.

One popular neobank for legal entities is Payoneer. This international organization provides all necessary business services, competitive rates, and transparency. Using Payoneer allows you to perform financial operations, manage accounting, and ensure data security.

Opening a Business Account

Having a business account in the company's name is essential for conducting financial operations, from transactions with clients to paying salaries. However, opening a business account in a UK bank can be inconvenient due to security requirements, such as the necessity for in-person presence to open an account. This can be an issue for entrepreneurs planning to operate entirely remotely.

A more convenient solution is using services like Neobanks. These online organizations offer all the services of a traditional bank, allowing you to open an account remotely in a minimal amount of time. Moreover, many neobanks offer more favorable rates due to their online format and lack of physical branches.

One popular neobank for legal entities is Payoneer. This international organization provides all necessary business services, competitive rates, and transparency. Using Payoneer allows you to perform financial operations, manage accounting, and ensure data security.

Прем’єр Гренландії закликав готуватись до американського вторгнення

Прем’єр Гренландії закликав готуватись до американського вторгнення

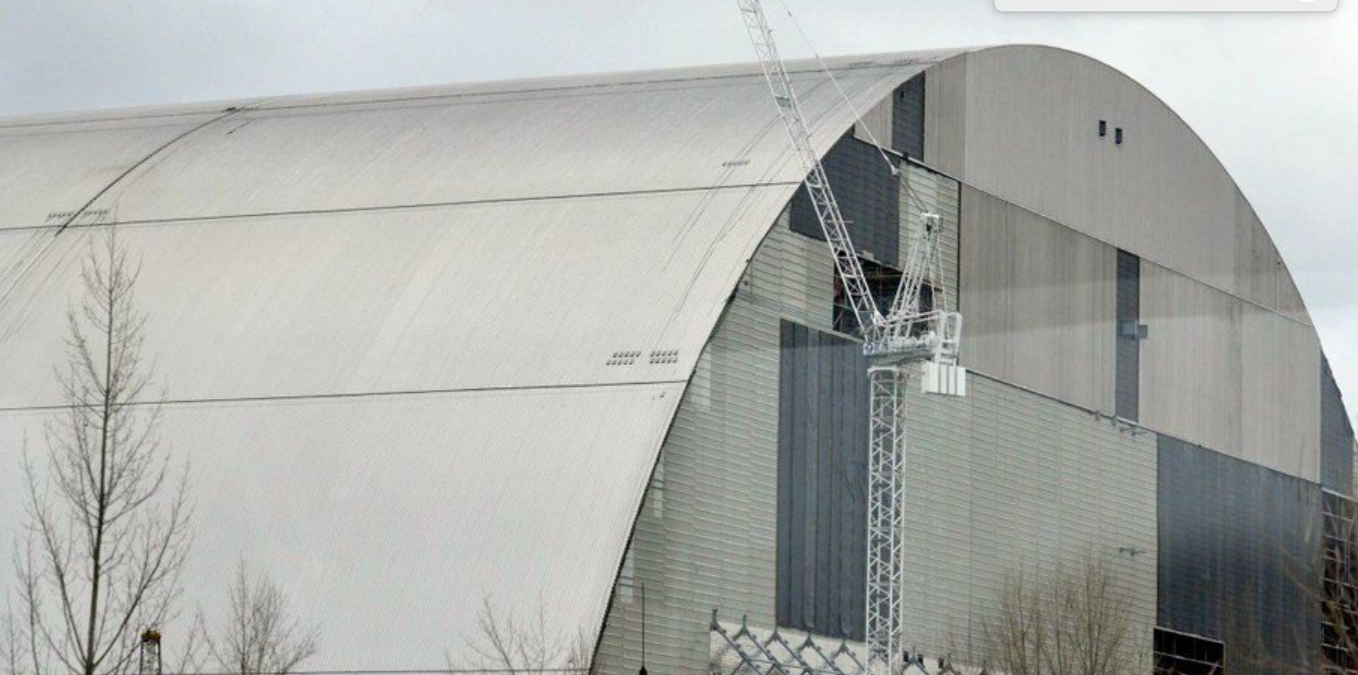

Через росіян Чорнобильська АЕС залишилася без зовнішнього енергопостачання

Через росіян Чорнобильська АЕС залишилася без зовнішнього енергопостачання

Допомога вже в дорозі: Трамп завернувся до іранського народу

Допомога вже в дорозі: Трамп завернувся до іранського народу

Золотий глобус-2026 - оголошено переможців премії

Золотий глобус-2026 - оголошено переможців премії

Росіяни атакувала Київ ракетами та дронами - є жертви та значні руйнування

Росіяни атакувала Київ ракетами та дронами - є жертви та значні руйнування